Helpful’s in my genes.

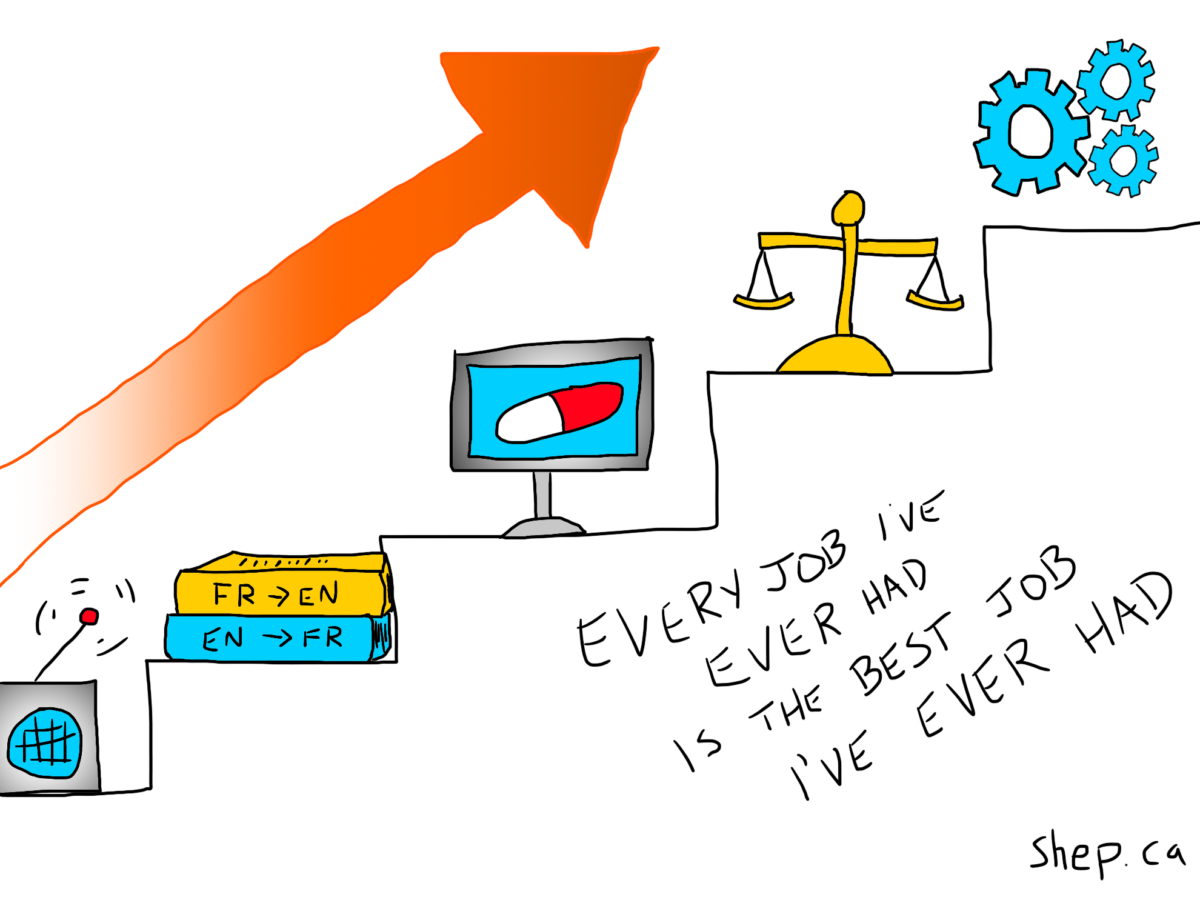

I can’t, er, help it — it’s a combination of positive attributes, like being somebody who cares about people and wants them to be happy, and negative attributes, like being an inveterate people-pleaser. It’s also in the professional DNA; marketing is a combination of being creative and being productive, where the desire to do and make interesting things intertwines with the desire to get stuff done and move projects forward.

It’s generally all good. Broadly speaking, wanting to get things done, and to help people, is a good way to be. Being a self-starter whose first instinct when I see a problem is to solve a problem has gotten me to pretty good places careerwise. It’s also won me a lot of friends.

So no problem, right?

Wrong.

The problem with being helpful is that it’s driven by an emotional state. Somebody’s in distress — external emotional state — or something isn’t right and it bugs me — internal emotional state.

Emotional states don’t necessarily lend themselves to super great decision making. I can get pulled down into a micro-focused area of detail while neglecting a broader, bigger priority. It’s the whole urgent vs. important issue, writ small, and writ constantly.

Being a manager — and managing good people who similarly want to help — has really helped me come to grips with this, and develop better strategies to make sure I’ve got my eyes on the big issues while still moving things forward on the micro level.

The analogy I’ve been using lately, which I’ve gotten quite fond of, is flipping turtles.

I watched Blade Runner a few times in university, I guess. For those who haven’t seen it, this is essentially the Blade Runner Turing test for replicants — androids passing as people.

“The tortoise lays on its back, its belly baking in the hot sun, beating its legs trying to turn itself over, but it can’t. Not without your help. But you’re not helping.” Why aren’t you helping? Are you a human, or a replicant?

The whole tortoise analogy sticks with me: it’s a great illustration for helping, especially the kind of minor-effort, costs-nothing help that people in creative roles can exercise a dozen times a day. It’s just another 15 minutes to make the web page look a bit better; it’s just five minutes to proofread something for somebody; it’ll only take an hour or so to fix this, or do that. Going the extra mile, bailing somebody out of a jam, taking care of something nobody’s even noticed is wrong (yet). Walking down the road, flipping turtles over. It feels great! Happy turtles all over the place.

And while I switch it to turtles (I like turtles! Plus, flipping a tortoise seems like it’d be a recipe for back strain.), it also conveys that pervasive guilt I feel for not helping. Every email unanswered in my inbox is a pang. Letting copy go out the door without making sure it’s absolutely deathless prose feels like shirking. Saying “no” to people is unsettling. I feel like I’m letting turtles bake in the hot sun. What’s wrong with me? Am I a replicant? Why am I not helping?

Because, as I’m now very fond of saying:

You can’t flip every turtle when the turtle farm’s on fire.

Me, July 2020 and constantly thereafter

And in roles like mine, the turtle farm is quite frequently on fire. COVID hasn’t made things easier, of course. Even outside of a COVID context, however, higher ed marketing and communications is in a continual state of expansion: the expectation is best-in-class websites running seamlessly on constantly varying and upgrading platforms; seamless adoption on new and evolving social media platforms with ever-changing algorithms; mastery of storytelling among wildly diverse audiences ranging from high-school students (and parents) to 75-year-old alumni to Nobel-prize-winning academics to industry leaders and government wonks; quality analytics and reporting on all channels to show value; broad strategic branding and positioning work; institutions are reckoning with their colonial pasts, and under constant scrutiny for past and current misdeeds on the diversity and inclusion front… and the beat goes on.

Which is the job. It’s a thrilling, evolving, breakneck process of continual evolution and refinement and I’m there for it.

But it does mean that various parts of the turtle farm are continuously and spontaneously bursting into flame. Plunging in and reprogramming how a page template renders images on a phone screen represents an hour you’re not spending on a plan to change CMSes and move your antiquated site to a whole new web platform. Re-reviewing a set of social posts for an upcoming speaker event is time you’re not spending on the annual budget. Helping proofread the annual report is time you’re not spending reviewing recruitment trends and making sure your tools and messages are on point for the latest iteration of messaging.

There are a lot of turtles to flip, and not flipping them can make you feel like a negligent monster.

But the turtle farm’s on fire. If the ten turtles flip today keep you from saving a hundred tomorrow, you’ve made a bad choice.

This isn’t a solve-the-problem post. It’s an articulate-the-problem post. Managing the work — figuring out what constitutes a turtle to flip, and what constitutes a turtle-farm-fire (and sometimes a flipped turtle is an indicator of a fire — maybe they’re flipping over in their hurry to flee the flaming turtle farm, and maybe I am investing too much thought in working this metaphor to death) is going to be something I unpack and look at a lot.

For now, though, the analogy stands. I like it. You have to stop flipping turtles when the turtle farm is on fire.

Now if you’ll excuse me, I’ve got some turtles to save.

Addendum: I solicited some friends for a name for a fictitious turtle sanctuary, thinking it’d play into the above somehow, but the name just didn’t seem to play out well in the context of the piece, and I wound up liking a farm more than a sanctuary because it sounds snappier (no pun intended) in a pithy phrase. Sorry, friends! Special shout out to Nathalie Noël for “Shellter,” the best turtle sanctuary name of them all.

And here is a list of more turtle sanctuary names, if anyone wants to start a turtle sanctuary. My gift to you.

- Turtville

- Slowpokes Ranch

- The Turt Yurt

- As The World Turts

- Turt Around, Bright Eyes

- She Shells Sanctuary

- Sancturtary

- Snap Judgments

- Sanctum Sancturtum

- Reptile Resort

- Turtal Recall