I’ve been expressing a desire/need for more market research at work recently.

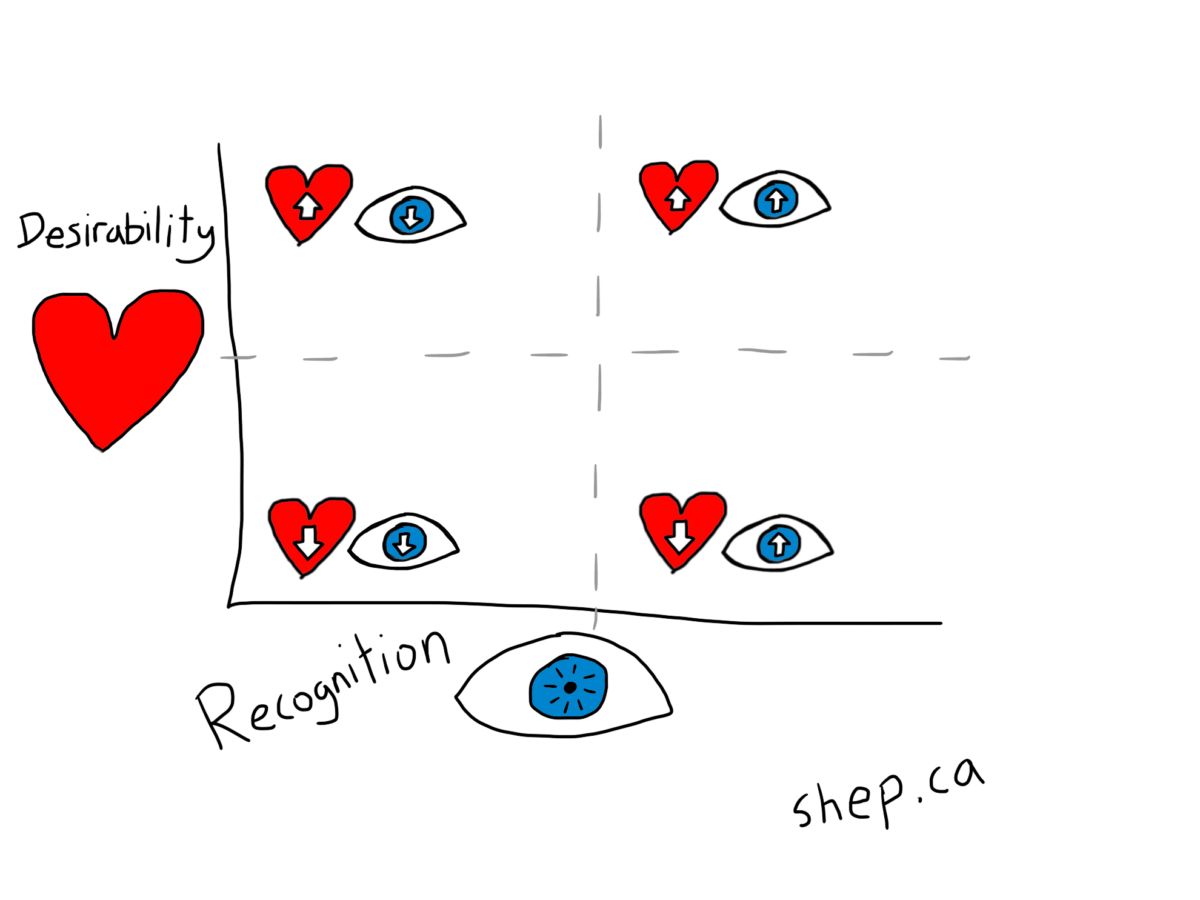

As always, I’ve sketched it out as a graphing project; what seemed easy/evident at first flush actually got tricky. It seems obvious when you look at it now, but sussing out the axes was a bit of a journey.

I work at an engineering school; one of the best in Canada; in some areas the very best in Canada and arguably the world. The key areas of focus in my role are:

- Student recruitment (undergraduate and graduate)

- Research promotion (which also drives faculty recruitment, and grad student recruitment)

- Alumni relations

- Reputational and rankings improvements

- Internal communications

For the purposes of graphing why market research is desirable, we’re making a huge, and possibly dangerous, assertion: that we know who our “key people” are. There are four to seven “key people” sets in the above list, depending on how you look at it (arguably even more).

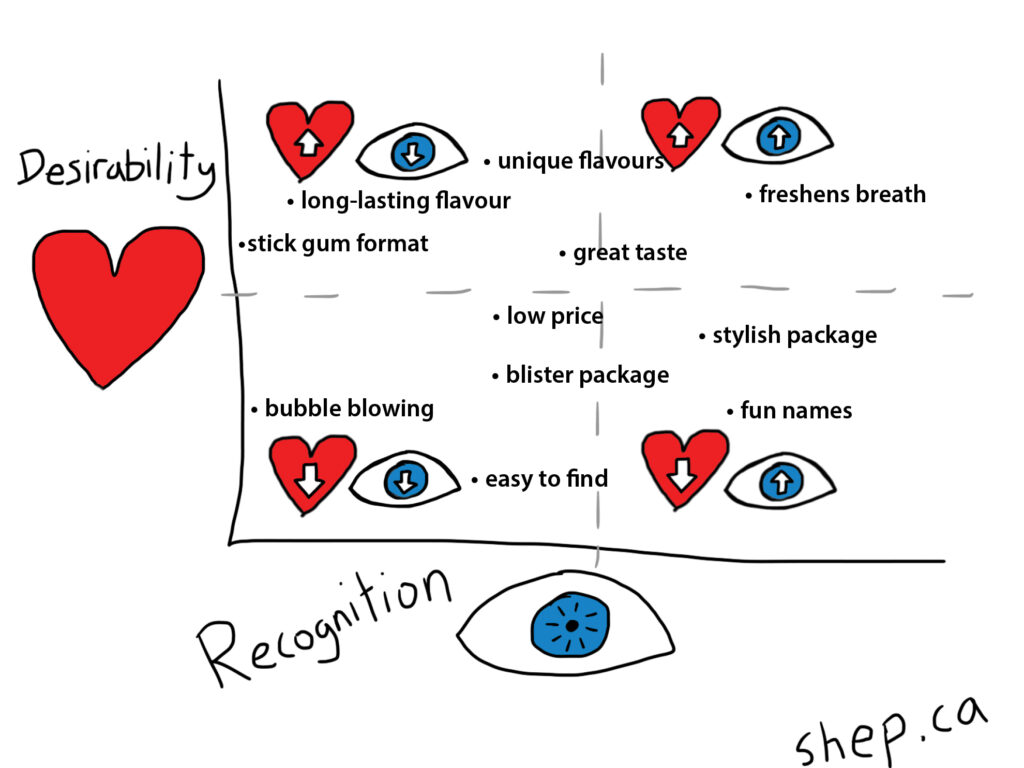

Let’s set up a graph. Hypothetically, we’re a small gum company; fun flavours and stylish packaging, great taste, not in every grocery store but well known thanks to some celebrities chewing our gum in public. Our key person in this case is an adult professional, not a 10-year-old child, which explains how some of these things plot:

This exercise will land you in four quadrants, each with their own vital question:

- Highly desired, not recognized for — this is a marketing problem. Your key people want it, you’re not telling them you have it.

- Not desired, not recognized for — this is a resource allocation problem. If people don’t want it, and they don’t care that we do it, why do it at all?

- Highly desired, highly recognized — have we succeeded to the point that sustained marketing is needed? What’s the competitive profile — can we afford to slack on this and focus on other areas, or do we need to maintain superiority?

- Not desired, but recognized for — do we want to stop working on talking about this (easy), or try to create desire for it among our key people (hard)?

Valuable stuff!

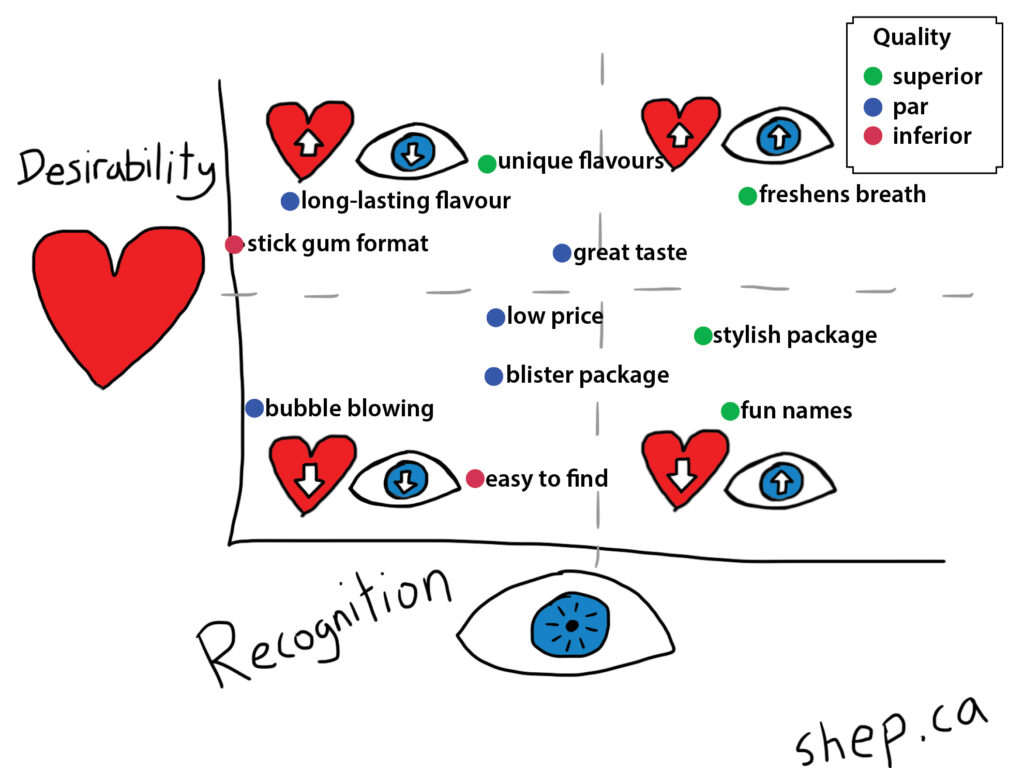

But it’s exponentially more valuable if paired with externally sourced and neutral evaluations of the same criteria. So once you’ve plotted your graph with market research, you also need (ideally concurrently) a Z-axis:

Of all the things you are evaluating, where are you offering something superior (or unique)? Where are you just on par, and where are you lagging?

We can then re-graph, using circle colour to denote one of three quality options…

This is where we move up from lower-tier marketing/communications (are we telling people what we want them to know?) and into the higher end of marketing: gauging true strengths and weaknesses, and making institutional, and frankly existential decisions about who we are and what we do.

This exercises moves us from four quadrants to twelve (superior, par, inferior), and three possible actions per quadrant. And some really rich, really challenging, questions.

IT’S TIME FOR A TABLE! Apologies for those of you on mobile.

| Desirability | Recognition | Quality | |

| High | Low | Inferior | Do we invest in improvement in this area, and further in becoming known for that investment and improvement? |

| High | Low | Par | Is this being marketed by other institutions — if not, do we want to try to seize that notional space and occupy the gap? |

| High | Low | Superior | How do we improve our recognition in this key, high-quality area? |

| Low | Low | Inferior | Are we investing resources here — and if so, why? |

| Low | Low | Par | If we are investing resources here, do we fish or cut bait? What rationale is there for improvement? |

| Low | Low | Superior | What value are we missing here? Should we be trying to drive more interest and recognition in this area? |

| Low | High | Inferior | How do we shift recognition in this area to a more important area that needs support? |

| Low | High | Par | Would improving quality in this recognized area put us in a position to create demand? |

| Low | High | Superior | Do we want to investigate opportunities to create desire in an area we excel at, and are known for? |

| High | High | Inferior | How do we improve the quality of this area, and avoid a worst-case scenario of disappointed and upset users? |

| High | High | Par | Do we need to invest in improving this area, or is our current level of quality competitive for the market? |

| High | High | Superior | Do we want to invest in this as a marketing exercise, or is it tapped out as a reputation driver? Does the competitive space allow us to slacken and reallocate resources? |

And now we’re into deep marketing work — digging into mission and values, looking hard at the actual markets you serve, and asking what, institutionally, you need to do to serve your interests but also best serve that market.

It’s worth reiterating that the wheels fall of this bus entirely if you don’t have a good and accurate idea of who “key people” are — once again, this takes you all the way back to mission and values, and your ultimate purpose in the market. Something as simple on its face as “student recruitment” begins to fragment quickly: do you only care about students with great GPAs? Students who demonstrate innovation and creativity? Students who might be a strong cultural fit in an institution with a strong cultural presences? Are EDII initiatives encouraging you to broaden your idea of an “ideal” student and market to different populations in new ways? And this for academics and researchers, for grad students, for alumni, for the general public… “key people” is a simplification, and itself a trap, if not approached prudently.

Both axes are also unpackable as their own research exercise. The “recognition” axis in particular demands its own approach: one that asks where your key people look for information, how they want that information presented to them, and whether you’re doing a good job at both of those things (and avoiding the places and formats they don’t care about). More graphs for another day…

January 3, 2021

Soundtrack: MF DOOM & Czarface, “Czarface Meets Metal Face”; Laurel Aitken, “Skinhead Train: The Complete Singles Collection 1969-70”; The Avalanches, “We Will Always Love You”.